pay ohio unemployment taxes online

True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits. The Ohio Department of Taxation is dedicated to providing quality and responsive service to you our individual and business taxpayers our state and local governments and the tax.

How Does Unemployment Insurance Work And How Is It Changing During The Coronavirus Pandemic

If you are remitting for both.

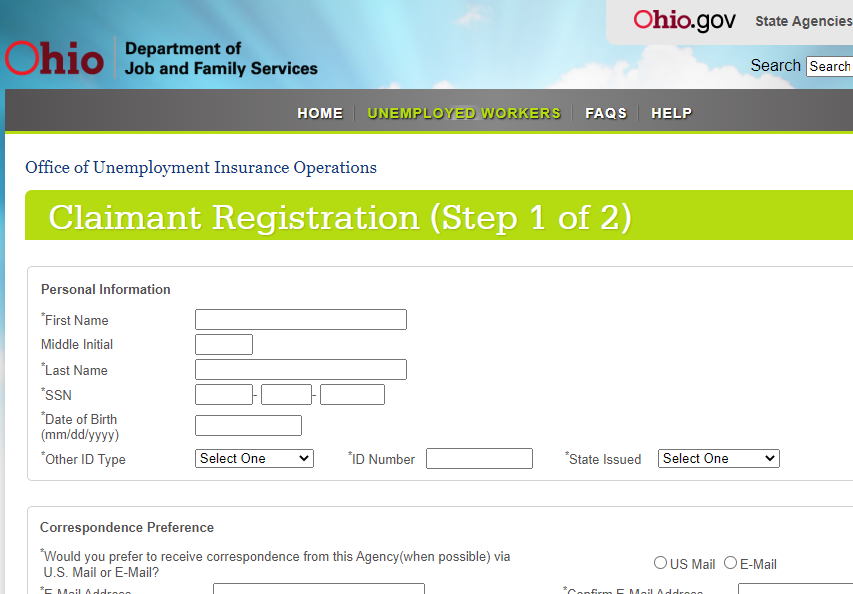

. Ohios New Unemployment Insurance Tax System Select who you are Employers. To file on paper use Form JFS-20125 Quarterly Tax Return which contains both required sections. To file and pay online you can use either the ERIC system or the Ohio Business Gateway.

To file your Quarterly Tax Return online please visit httpsthesourcejfsohiogov The SOURCE. To make a payment for your entire account balance select Pay link next to the Effective Balance. Used by employers to authorize someone.

Avoid the cost and stress of mailing paper checks by paying your unemployment insurance taxes online through The SOURCE. If you are remitting for both. Commercial Activity Tax CAT Corporation Franchise Tax No Longer in Effect Employer Withholding.

Any payment authorized through. Additional information about the Ohio Unemployment Tax can be obtained from our home. JFS-20106 Employers Representative Authorization for Taxes.

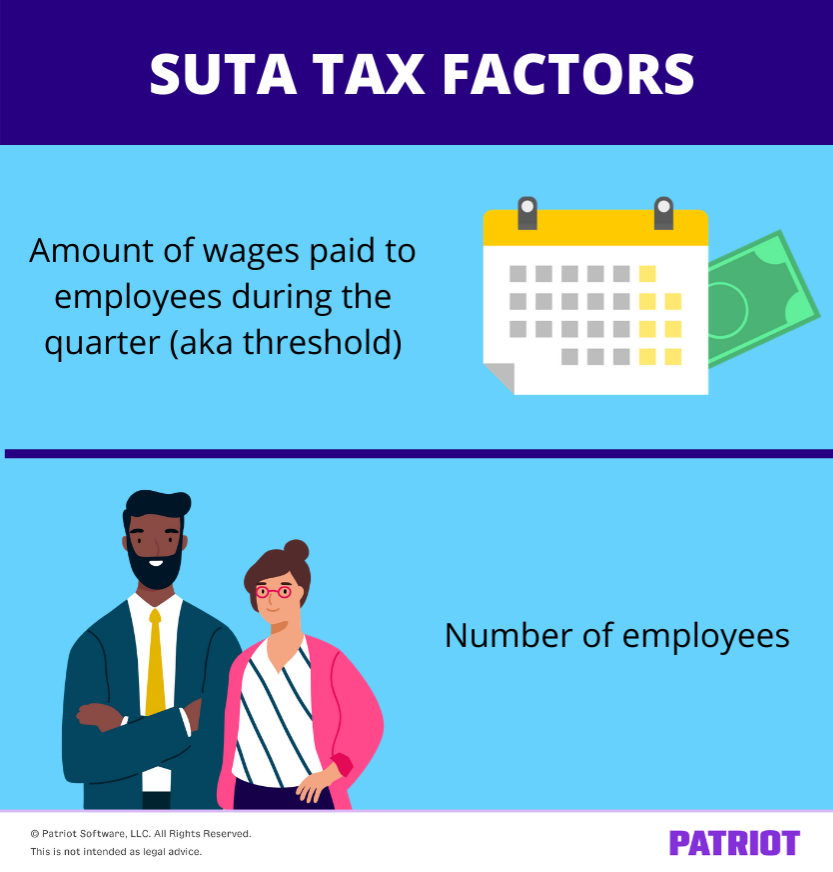

Applying for unemployment benefits online is much faster than applying by phone according to state officials. Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. Unemployment Tax Payment Process.

To submit your quarterly tax report online please visit httpsthesourcejfsohiogov. For general payment questions call us toll-free at 1-800-282-1780 1-800-750-0750 for persons who use text telephones TTYs or adaptive telephone equipment. Employers who pay unemployment contributions.

For general payment questions call us toll-free at 1-800-282-1780 1-800-750-0750 for persons who use text telephones TTYs or adaptive telephone equipment. Financial Institutions Tax FIT Gross Casino. Click here if you have paid wages under covered employment or if you have an.

Apply by phone Monday through Friday except holidays from 8 am. To make a Report Payment select Pay link under Quarters tab. Apply Online For Unemployment In Ohio.

You also can file a wage report online or adjust a filed wage report online. To 5 pm by calling 877 644. Unemployment Taxes ERIC Unemployment Benefits OJI Recruit and Hire Workers.

Electronic payments can be made by ACH Debit ACH Credit and. File for unemployment benefits online 247 at unemploymentohiogov. To file and pay online you can use either the ERIC system or the Ohio Business Gateway.

Additional information about the. Unemployment Q. Filing Your Weekly Claims.

Please use the following steps in paying your. File Unemployment Taxes Online. Welcome to The SOURCE.

To pay by credit card or debit card using a touch-tone telephone call the toll-free number 1-800-2PAY-TAX 1-800-272-9829. Enter Ohios Business Tax Jurisdiction Code 6447 when.

Tax Form Available Online For Missourians Who Claimed Unemployment Benefits In 2020

/cloudfront-us-east-1.images.arcpublishing.com/gray/5BNGIVBY5BFQDHIDXVARCYZGKM.png)

Pandemic Unemployment Assistance Now Available For Ohioans

Auglaize County Sheriff S Office We Have Received Several Calls Regarding Citizens Receiving 1099 G Forms That Have Not Filed For Unemployment We Ask That You File A Report With Ohio Department Of

Unemployment Benefits In Ohio How To Get The Tax Break

Ohio Waivers Now Available For Pandemic Unemployment Overpayments Cleveland Com

Unemployment Compensation For Low Paid Workers

State Says It S Paid All Approved Unemployment Claims Up To Now Working On Resolving More Wsyx

Can I Apply For Ohio Unemployment Benefits If I Am Self Employed Wtol Com

State Says 92 Of Ohio S 1 2 Million Unemployment Applications Have Been Processed Wkyc Com

Suta Tax Requirements For Employers State By State Guide

Ohio Income Taxes Unemployment Benefits From 2020 Won T Be Taxed For Most Filers

Perry Jfs The Facts About Unemployment In Ohio Here S Another Fact Your Ohiomeansjobs Center In Perry County Is Here To Help You With Job Loss Contact Us Today To See How

Ohio Targets Fraud As 1099 G Tax Form Distribution Begins Business Journal Daily The Youngstown Publishing Company

Ohio Adds Unemployment Security Feature Says Previously Denied Pua Claims May Now Be Eligible

Overwhelmed And Underprepared Unemployment System Fails Ohioans

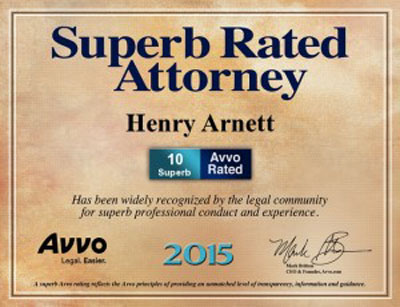

Columbus Ohio Unemployment Compensation Livorno Arnett Co Lpa

Unemployment Claims To Reopen This Weekend For 100 000 Ohioans Target Date For A Separate Pua Unemployment Group Moved Up Cleveland Com